Some applications can be obtained to both equally initially-time and repeat customers, as well. Look at what unique lenders supply And just how That may affect your budget.

APR one The once-a-year proportion fee (APR) represents the accurate annually Value of the mortgage, such as any fees or prices In combination with the particular interest you fork out to the lender. The APR may very well be increased or lowered once the closing date for adjustable-rate mortgages (ARM) financial loans.

A lot of these loans generally call for more substantial down payments than authorities-backed mortgages. In order to avoid needing to pay for for private mortgage coverage (PMI), which shields the lender in the celebration you default, you’ll have to have to produce a twenty percent down payment.

APR 1 The yearly percentage level (APR) represents the legitimate yearly cost within your mortgage, together with any charges or costs Besides the particular interest you shell out for the lender. The APR may very well be elevated or lowered once the closing day for adjustable-price mortgages (ARM) loans.

The desire price is the amount your lender expenses you for working with their income. It's proven being a proportion within your principal mortgage amount of money. ARM bank loan costs are dependant on an index and margin and may adjust as outlined as part of your settlement.

The month to month payment revealed is made up of principal and curiosity. It does not include things like quantities for taxes and insurance policy premiums. The regular monthly payment obligation will be higher if taxes and insurance policy are involved.

Exactly what is the difference between a set and adjustable level mortgage? In the case of a set-amount mortgage, the rate is continual for the whole period of the bank loan. However, an adjustable-price mortgage or ARM is dependent that you can buy forces. What are the mortgage prices in Florida? Mortgage costs in Florida are the interest lenders charge for refinancing or residence loans. These mortgage costs instantly influence the overall borrowing expenses in florida delayed financing Florida. What exactly are The present mortgage premiums in Florida? The present mortgage premiums in Florida for various financial loan goods is often seen within the desk higher than. The prices are up-to-date 2 times daily to make sure that our clients and guests to our site normally have accurate estimates of on a daily basis’s mortgage fees. Find out more Florida First-time Homebuyer Systems

Even so, the lender doesn’t offer Digital notarization or closing solutions, which lowered its score marginally.

From affordable inland regions into the quirky Keys and Miami's luxury beachfront living, the Sunshine State presents eye-catching shopping for and investing possibilities. Here's an overview of Florida's mortgage and housing market place.

The curiosity price from the Florida Help Next Mortgage Program is zero, and there is the choice of deferring a 2nd mortgage. It has to be paid in the event the proprietor sells the home or refinances the main Mortgage. Other vital capabilities are -

The regular payment demonstrated is built up of principal and fascination. It does not involve amounts for taxes and insurance rates. The every month payment obligation will likely be better if taxes and insurance coverage are provided.

The curiosity charges from the Florida Hometown Heroes Application are comparatively lessen and down below the marketplace and feature deposit support and shutting cost guidance. Potential buyers will also be not needed to pay the origination charges.

All round, nevertheless, median property charges in the Sunshine Condition are greater when compared to the national median and are actually growing over the past year, In keeping with Redfin. In the event you’re hoping to get a house below, comparing mortgage lenders is key. Listed below are Bankrate’s picks for the most beneficial lenders inside the point out.

How frequently do mortgage costs improve? Mortgage charges can fluctuate day by day. There are plenty of aspects that can influence interest fees, like inflation, the bond market place and the general housing sector.

Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Tatyana Ali Then & Now!

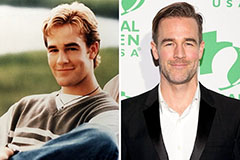

Tatyana Ali Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!